2023 Management Information Circular

Notice of annual meeting of shareholders

2023 Management information circular Manulife Financial Corporation Annual Meeting May 11, 2023 Notice of annual meeting of shareholders Your participation is important. Please read this document and vote.

Notice of annual meeting of common shareholders You’re invited to attend our 2023 annual meeting of common shareholders When Four items of business May 11, 2023 • Receiving the consolidated financial statements and 11 a.m. (Eastern time) auditors’ reports for the year ended December 31, 2022 Where • Electing directors • Appointing the auditors Manulife Head Office • Having a say on executive pay 200 Bloor Street East Toronto, Canada Other matters that are properly brought before the meeting will be How to attend considered, but we are not aware of any at this time. The annual Our 2023 annual meeting for The Manufacturers Life Insurance Company will be held at meeting will be held the same time and will also be held in person and by live webcast. in person at the address Anyone can attend the meeting, but you need to register as a above and by live shareholder or proxyholder to vote or ask questions. webcast online at By order of the board of directors, https:// web.lumiagm.com/ 467771061 Please read the voting Antonella Deo section starting on Corporate Secretary page 6 for detailed information about how to March 15, 2023 attend the meeting, vote and ask questions. More information and updates on how to attend the meeting will be made available on our website (https:// www.manulife.com/en/ investors/annual- meeting.html).

Message to shareholders Don Lindsay Chair of the Board Dear fellow shareholders, On behalf of the board of directors, we are pleased to invite you to the annual meeting of common shareholders of Manulife Financial Corporation on May 11, 2023. As a holder of common shares, you have the right to receive our financial statements and vote your shares at the meeting. Our 2023 management information circular, which starts on page 2, includes important information about the business of the meeting and the items you will be voting on, as well as information about our corporate governance practices and executive compensation program. Please read the circular before you vote your shares. Manulife continues to accelerate growth, leveraging the solid foundation that we have built for future success. Over the past several years, Roy Gori and the executive leadership team have continued to show steadfast leadership, anchored always in our values. Their commitment, ownership and spirit have driven resilient results despite the challenges and impacts presented by an unpredictable macroeconomic environment and an unprecedented global pandemic. With their leadership, and the strength of Manulife’s global team, the company has delivered on key commitments made to shareholders, and achieved record net income in 2022. Your Board has remained focused on providing oversight and guidance to the leadership team to ensure effective oversight of the company given its current operations and strategy. After nearly two years of virtual meetings, the opportunity to adopt a hybrid meeting schedule has enabled optimal participation from our directors and enhanced our ability to attract talented directors from around the globe. We have also continued our focus on board succession and diversity. You can read more about our progress on these matters and others throughout the circular, including that women represent seven of the 11 independent directors nominated for election. On behalf of the Board and Manulife’s shareholders, customers, and colleagues, I would like to offer our sincere thanks to John Cassaday for his 30 years of service. We have marked many milestones during that time, and we are grateful for his unwavering leadership and many contributions to the Company. John’s sense of duty, grace, insight, and wisdom have served the Company well, and he will be missed. We wish him the very best in his future endeavours. We would also like to thank Joseph Caron, whose term as director will end at the close of our 2023 annual meeting, for his 12 years of service and dedication. His many contributions to Manulife are greatly appreciated. Looking to the future, I appreciate the trust you have placed in me and I am humbled to serve as the Chair of your Board as we work together to achieve our bold ambition. You can read about Manulife’s accomplishments in 2022 and their impact on our executive pay beginning on page 40. You will also find a more detailed discussion of the year’s performance and Manulife’s strategic progress in our 2022 annual report - available at manulife.com. Please read the circular and vote your shares The meeting will be held in person and by live webcast on May 11, 2023 at 11:00 a.m. (Eastern time). You can find information about how to attend the meeting on page 6. Your vote is important to us – we encourage you to consider the information set out in the circular and exercise your voting rights. See page 7 for details about how to vote. The meeting will cover four items of business: (1) receiving our financial statements; (2) voting to elect directors; (3) voting to appoint the auditors; and (4) voting to have a ‘say on executive pay’. You will vote on all items except for the financial statements. The board recommends you vote FOR items 2 to 4. We look forward to welcoming you at the meeting. Don Lindsay Chair of the Board March 15, 2023 2023 Management information circular 1

About this Management Information Circular This management information circular is being made available to you because you owned common shares of Manulife Financial Corporation as of the close of business on March 15, 2023. It includes important information about the meeting, the items of business to be covered and how to vote your shares. You’re entitled to receive notice of, and vote these shares at, our 2023 annual meeting of common shareholders. Management is soliciting your proxy for the meeting, which means we’re contacting you to encourage you to vote. This will be done mainly by mail, but you may also be contacted by phone, including in connection ™ with the use of the Broadridge QuickVote service. We have retained Kingsdale Advisors (Kingsdale), and they may assist us with this process. We pay the costs of the engagement with Kingsdale, which we expect to be approximately $47,250. In this document: • we, us, our, company and Manulife mean Manulife Financial Corporation • you, your and shareholder refer to holders of Manulife common shares • circular means this management information circular • meeting means our annual meeting of common shareholders on May 11, 2023 • common shares or shares means common shares of Manulife Financial Corporation • Manufacturers Life means The Manufacturers Life Insurance Company Information in this circular is as at February 28, 2023 and in Canadian dollars, unless indicated otherwise. Any information contained in, or otherwise accessible through, websites mentioned in this circular does not form a part of this document. For more information You can find financial information about Manulife in our 2022 annual report, which includes our audited consolidated financial statements and management’s discussion and analysis (MD&A) for the year ended December 31, 2022. The audit committee section of our annual information form has information about the audit committee, including the committee charter. These documents are available on manulife.com, on SEDAR (sedar.com), and on EDGAR (sec.gov/edgar). You can also ask us for a copy of our 2022 annual report – simply email us at shareholder_services@manulife.com. Important information about your shares Third parties may contact you with unsolicited offers to buy your shares, often at prices below market value. Securities administrators in Canada and the U.S. have expressed serious concerns about these types of offers, including the possibility that investors might tender to such offers without understanding the offer price relative to the actual market price of their securities. Investors should exercise caution with these types of offers. Manulife is not associated with these offers and does not endorse or approve them. If you are contacted with an offer to buy your Manulife shares or have any questions about your shares, please speak with your investment advisor or contact TSX Trust at 1-800-783-9495 (Canadian residents), 1-800-249-7702 (U.S. residents) or 416-682-3864. 2 Manulife Financial Corporation

Delivery of the 2023 management information circular As permitted by the Canadian Securities Administrators and pursuant to an exemption from the proxy solicitation requirement received from the Office of the Superintendent of Financial Institutions Canada, we are using notice and access to deliver this circular to both our registered and non-registered (beneficial) shareholders. What is notice and access? Instead of receiving a paper copy of the circular, a package was sent to shareholders with a notice explaining how to access the circular online and how to request a paper copy. A form of proxy for registered shareholders and ownership statement holders, or a voting instruction form for non-registered (beneficial) shareholders, was included with the notice with instructions so you can vote your shares. How to access the circular online Our website: https://www.manulife.com/en/investors/annual-meeting.html Our transfer agent’s website: www.meetingdocuments.com/TSXT/MFC On SEDAR: www.sedar.com How to request a paper copy of the circular Shareholders may request a paper copy of the circular up to one year from the date the circular was filed on SEDAR. If you would like to receive a paper copy prior to the meeting, please follow the instructions provided in the notice or make a request by going to www.meetingdocuments.com/TSXT/MFC or contacting our transfer agent, TSX Trust Company (TSX Trust), via telephone at 1-888-433-6443 (toll free in Canada and the United States) or 416-682-3801, or via email at tsxt-fulfilment@tmx.com. If you have questions about notice and access please call TSX Trust at 1-800-783-9495 (Canadian residents), 1-800-249-7702 (U.S. residents) or 416-682-3864. Sign up for e-delivery We want to provide you with information the way you want to receive it. You can choose to receive your shareholder materials online instead of in the mail. Non-registered (beneficial) shareholders Visit proxyvote.com and enter the control number from your voting instruction form. Select “sign up” to go paperless. Registered shareholders and non-registered ownership statement holders Visit tsxtrust.com/MFCdigital and follow the instructions. 2023 Management information circular 3

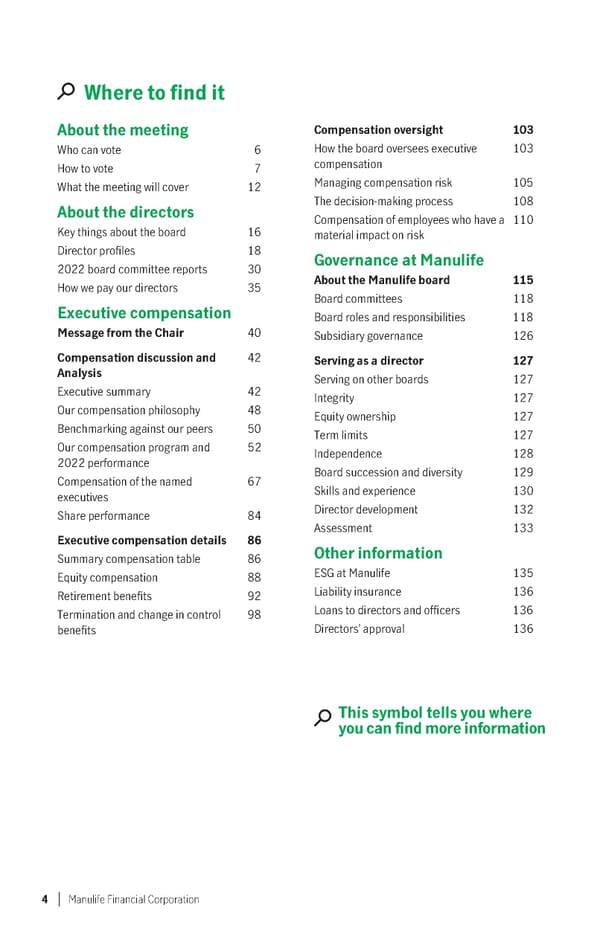

Where to find it About the meeting Compensation oversight 103 Who can vote 6 How the board oversees executive 103 How to vote 7 compensation What the meeting will cover 12 Managing compensation risk 105 About the directors The decision-making process 108 Compensation of employees who have a 110 Key things about the board 16 material impact on risk Director profiles 18 Governance at Manulife 2022 board committee reports 30 About the Manulife board 115 How we pay our directors 35 Board committees 118 Executive compensation Board roles and responsibilities 118 Message from the Chair 40 Subsidiary governance 126 Compensation discussion and 42 Serving as a director 127 Analysis Serving on other boards 127 Executive summary 42 Integrity 127 Our compensation philosophy 48 Equity ownership 127 Benchmarking against our peers 50 Term limits 127 Our compensation program and 52 Independence 128 2022 performance Board succession and diversity 129 Compensation of the named 67 Skills and experience 130 executives Share performance 84 Director development 132 Assessment 133 Executive compensation details 86 Other information Summary compensation table 86 Equity compensation 88 ESG at Manulife 135 Retirement benefits 92 Liability insurance 136 Termination and change in control 98 Loans to directors and officers 136 benefits Directors’ approval 136 This symbol tells you where you can find more information 4 Manulife Financial Corporation

About the meeting This year’s annual meeting is on May 11, 2023. Read this section to find out who can vote, how you can vote and what you will be voting on. Questions? Call our transfer agent in your region if you have any questions about the meeting. Registered holders can also call our transfer agent to get information on options for managing your share account. Canada 1-800-783-9495 United States 1-800-249-7702 Hong Kong 852-2980-1333 Philippines 632-5318-8567 Where to find it Who can vote 6 How to vote 7 What the meeting will cover 12 2023 Management information circular 5

Who can vote If you held Manulife common shares as of 5 p.m. About quorum (Eastern time) on March 15, 2023 (the record Before the meeting can go ahead, at least two date), you’re entitled to receive notice of, and shareholders have to be present at the vote at, our 2023 annual meeting. We had meeting, in person or by proxy. 1,858,297,688 common shares outstanding as of this date and each share carries one vote. We must receive a simple majority of votes cast for an item to be approved. Voting restrictions Shares beneficially owned by the following entities and persons cannot be voted (except in circumstances approved by the Minister of Finance (Canada)): • the Government of Canada or any of its political subdivisions or agencies • the government of a province or any of its political subdivisions or agencies • the government of a foreign country or any foreign government’s political subdivisions or agencies • any person who has acquired more than 10% of any class of shares of Manulife. Also, if any person, an entity controlled by any person, or any person together with an entity that person controls, beneficially owns more than 20% of the shares that can be voted, that person or entity cannot vote unless the Minister of Finance (Canada) allows it. We are not aware of any person who beneficially owns or exercises control or direction (directly or indirectly) over more than 10% of the voting rights attached to Manulife common shares. How to attend the meeting In person The meeting will be held at our head office in Toronto at 200 Bloor Street East on May 11, 2023 at 11:00 a.m. (Eastern time). Please register with our transfer agent when you arrive. Online as a shareholder Shareholders and their duly appointed 1. Log in: https://web.lumiagm.com/ proxyholders will be able to ask questions 467771061. The link will be accessible one and vote during the meeting. For more hour before the meeting start time to allow information about how to vote during the you to test your connection meeting and ask questions, please see pages 2. Click “I have a control number” 7 to 10. Additional instructions will be 3. Enter your control number (see pages 7 to provided at the meeting, as necessary. 11 for more information) Questions should be of interest to all 4. Enter your password: “manulife2023” (case shareholders, not personal in nature. If your sensitive) question relates to a personal matter, we will contact you after the meeting to follow up on Online as a guest your question. If we cannot answer a question 1. Log in: https://web.lumiagm.com/ during the meeting because of timing or 467771061. technical limitations, we will follow up with 2. Click “I am a guest” and then complete the you as soon as practicable after the meeting. required fields. Anyone can attend the meeting as a guest, but guests cannot vote or ask questions. More information and updates on how to attend the meeting will be available on our website (https://www.manulife.com/en/ investors/annual-meeting.html). 6 Manulife Financial Corporation

About the Meeting Please make sure your browser is compatible before you try to access the meeting online To access the meeting online either as a shareholder or a guest you will need the latest versions of Chrome, Safari, Edge or Firefox. Please do not use Internet Explorer. You should log in early to make sure your browser is compatible. Internal network security protocols including firewalls and virtual private network (VPN) connections may block access. If you are experiencing any difficulty connecting or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted by the security settings of your organization. In the event of difficulties during the registration process or with accessing and attending the meeting, please contact TSX Trust at 1-800-783-9495 (Canadian residents), 1-800-249-7702 (U.S. residents) or 416-682-3864 (rest of world). How to vote There are two ways to vote – by proxy before the meeting, or during the meeting. How you vote depends on whether you’re a registered shareholder, an ownership statement holder or a non-registered (beneficial) shareholder. Shareholders are encouraged to vote their shares and submit proxies before the meeting. Registered shareholders and non-registered ownership See page 11 for statement holders (your package includes a proxy form) important details You’re a registered shareholder if you have a share certificate in your about voting by name or your shares are recorded electronically in the Direct proxy. Registration System (DRS) maintained by our transfer agent. You’re an ownership statement holder if you hold a share ownership statement that was issued when Manufacturers Life demutualized. Vote by proxy You can vote your shares in one of four ways: You or your authorized On the internet – Go to the website indicated on your proxy form. representative must You will need complete the proxy form. the personal identification/control number on the form. If you’re a corporation or By phone (Canada and U.S. only) – Call the toll-free number on other legal entity, your the proxy form and follow the instructions. You will need the authorized representative personal identification/control number on the form. must complete the form. By mail – Complete your proxy form and return it in the envelope provided. On your smartphone – Use the QR code found on your proxy form. Your proxy must be received by 5 p.m. (Eastern time) on May 9, 2023 for your vote to be counted. If you’re mailing your proxy form, be sure to allow enough time for the envelope to be delivered. The deadline for the deposit of proxies can be waived by the Chair of the Board at his discretion, without notice. If the meeting is adjourned, your proxy must be received by 5 p.m. (Eastern time) two business days before the meeting is reconvened. Vote in person at the Check in with our transfer agent when you arrive at the meeting. meeting Do not complete the proxy form before the meeting because you’ll vote in You will need to bring person at the meeting. photo identification with you to the meeting. 2023 Management information circular 7

Registered shareholders and non-registered ownership statement holders (continued) Vote online during the On the day of the meeting: meeting 1. Log in: https://web.lumiagm.com/467771061. The link will be You will find your control accessible one hour before the meeting start time to allow you to number on the proxy form test your connection included with your 2. Click “I have a control number” meeting materials. 3. Enter your control number (on the proxy form included with the You will need your control meeting materials) 4. Enter your password: “manulife2023” (case sensitive) number to be able to vote 5. Follow the instructions to cast your vote. or ask questions at the If you have already voted by proxy, your vote at the meeting, if properly meeting. cast, will automatically revoke your previous vote. Changing your vote Sending new voting instructions with a later date will revoke the You can revoke your instructions you previously submitted. proxy form if you You can send a new proxy on the internet, by phone or by mail, by change your mind about following the instructions above. Or send a notice in writing, signed by how you want to vote you or your authorized representative to: Corporate Secretary, Manulife your shares. Financial Corporation, 200 Bloor Street East, Toronto, Canada M4W 1E5. Your new proxy must be received by 5 p.m. (Eastern time) on May 9, 2023 for your vote to be counted. If you’re mailing your new proxy form, be sure to allow enough time for the envelope to be delivered. If the meeting is adjourned, your proxy must be received by 5 p.m. (Eastern time) two business days before the meeting is reconvened. If you miss the deadline, you can only revoke your proxy by giving a notice in writing to the Chair of the Board before the meeting begins. The notice must be signed by you or your authorized representative. 8 Manulife Financial Corporation

About the Meeting Non-registered (beneficial) shareholders See page 11 for (your package includes a voting instruction form) important details You’re a non-registered shareholder if you hold your shares through an about voting by intermediary (a bank, trust company, securities broker or other financial proxy. institution). This means the shares are registered in your intermediary’s name and you’re the beneficial shareholder. Vote by proxy You can vote your shares in one of four ways: You or your authorized On the internet – Go to the website indicated on your voting representative must instruction form and follow the instructions on screen. complete the voting By phone (Canada and U.S. only) – Call the toll-free number on instruction form. If your voting instruction form and follow the instructions. you’re a corporation or other legal entity, your authorized By mail – Complete your voting instruction form and return it in representative must the envelope provided. complete the form. On your smartphone – Use the QR code found on your voting instruction form. Your intermediary must receive your voting instructions with enough time to act on your instructions. Check the form for the deadline for submitting your voting instructions. If you’re mailing your voting instruction form, be sure to allow enough time for the envelope to be delivered. The deadline for the deposit of proxies can be waived by the Chair of the Board at his discretion, without notice. Vote in person at First, appoint yourself as proxyholder by printing your name in the space the meeting provided on the voting instruction form. You can also appoint someone You must appoint else to be your proxyholder (see page 11 for more information). You can yourself (or another do this in one of two ways: person) as • sign and return the form in the envelope provided but do not fill in your proxyholder. voting instructions because you will vote during the meeting (check the Then you or the form for the deadline for submitting it, and make sure you allow enough person you appoint time for the envelope to be delivered), or need to bring photo • go to the website indicated on the voting instruction form and follow the identification with instructions. you to the meeting. Then, when you arrive at the meeting, check in with our transfer agent. 2023 Management information circular 9

Non-registered (beneficial) shareholders (continued) Vote online during First, appoint yourself as proxyholder by printing your name in the space the voting instruction form. You can also appoint someone else the meeting provided on You must appoint to be your proxyholder (see page 11 for more information). You can do this yourself (or another in one of two ways: person) as • sign and return the form in the envelope provided but do not fill in your proxyholder. voting instructions because you will vote online during the meeting (check Then you or the the form for the deadline for submitting it, and make sure you allow person you appoint enough time for the envelope to be delivered), or must contact TSX • go to the website indicated on the voting instruction form and follow the Trust to get a control instructions. number. Then get a control number by contacting TSX Trust by no later than 5 p.m. You need a control (Eastern time) on May 9, 202 . You can do this in one of two ways: number to be able to • call 1-866-751-6315 (within North America) or 647-252-9650 (outside vote or ask questions of North America), or at the meeting. • go online at www.tsxtrust.com/control-number-request If you appointed someone else to be your proxyholder, that person must contact TSX Trust to get a control number. On the day of the meeting: 1. Log in: https://web.lumiagm.com/467771061. The link will be accessible one hour before the meeting start time to allow you to test your connection 2. Click “I have a control number” 3. Enter your control number 4. Enter your password: “manulife2023” (case sensitive) 5. Follow the instructions to cast your vote. If you have already voted by proxy, your vote at the meeting, if properly cast, will automatically revoke your previous vote. Changing your vote Follow the instructions on your voting instruction form, or contact your You can revoke your intermediary for more information. voting instruction Your intermediary must receive your voting instructions with enough time form if you change to act on your instructions. Check the form for the deadline for submitting your mind about how your voting instructions. If you’re mailing your voting instruction form, be you want to vote your sure to allow enough time for the envelope to be delivered. The deadline for shares. the deposit of proxies may be waived or extended by the Chair of the Board at his discretion, without notice. 10 Manulife Financial Corporation

About the Meeting More about voting by proxy Voting by proxy is the easiest way to vote. It About confidentiality and voting results means you’re giving someone else (your Our transfer agent independently counts and proxyholder) the authority to attend the meeting tabulates the votes to maintain confidentiality. and vote for you according to your instructions. A proxy form or voting instruction form is only Roy Gori, President and Chief Executive Officer referred to us if it’s clear that a shareholder or, in his place, Donald R. Lindsay, Chair of the wants to communicate with the board or Board (with full power of substitution) have management, the validity of the form is in agreed to act as Manulife proxyholders to vote question, or the law requires it. your shares at the meeting according to your After the meeting the voting results will be instructions. If you do not name a different posted on manulife.com, on SEDAR proxyholder when you complete your form, you (sedar.com), and on EDGAR (sec.gov/edgar). are authorizing Mr. Gori or Mr. Lindsay to act as your proxyholder to vote for you at the meeting according to your instructions. If you do not indicate on the form how you want to vote your shares, Mr. Gori or Mr. Lindsay will vote: • FOR the election of each of the nominated directors in this circular • FOR the appointment of Ernst & Young LLP as auditors • FOR the advisory vote on our approach to executive compensation You can also appoint someone else to be your proxyholder – that individual does not need to be a Manulife shareholder. To do so, print the person’s name in the blank space on the proxy form or voting instruction form, sign and return the form in the envelope provided but do not fill in your voting instructions because your proxyholder will vote during the meeting (check the form for the deadline for submitting it, and make sure you allow enough time for the envelope to be delivered), or go to the website indicated on the proxy form or voting instruction form and follow the instructions. Once your intermediary receives your instructions your proxyholder needs to either attend the meeting in person (please have your proxyholder bring photo ID to the meeting) or get a control number to attend the meeting online by contacting TSX Trust by no later than 5 p.m. (Eastern time) on May 9, 2023. They can do this in one of two ways: • call 1-866-751-6315 (within North America) or 647-252-9650 (outside of North America), or • go online at www.tsxtrust.com/control-number-request. If there are amendments to the items to be voted on or any other matters that are properly brought before the meeting or any adjournment, your proxyholder can vote your shares as they see fit. Questions? Call the transfer agent in your region if you have any questions or to ask for a new proxy form (see page 5 for details). 2023 Management information circular 11

What the meeting will cover The meeting will cover four items of business. 1. Financial statements (manulife.com) Our 2022 consolidated financial statements and the auditors’ reports on those financial statements will be presented at the meeting. You can find a copy in our 2022 annual report on manulife.com. 2. Electing directors (see page 15) You will elect 12 directors to serve on our board until either the end of next year’s annual meeting of shareholders, or earlier if they leave the board. All nominated directors were elected at our 2022 meeting. You can read about the nominated directors beginning on page 15. The board recommends that you vote FOR the election of each nominated director. 3. Appointing the auditors Ernst & Young LLP (Ernst & Young) (or a predecessor) have acted as external auditors to Manulife or an entity within the Manulife group of entities since 1905. The audit committee has recommended that the board re-appoint them as our auditors for fiscal 2023 to serve until the end of our next annual meeting. We plan to initiate a tendering process for the audit engagement in 2024 once the adoption of IFRS 17 (Insurance Contracts) (IFRS 17) and first annual audit cycle is complete. Given the complexities associated with IFRS 17, the audit committee does not think it would be prudent to initiate a tendering process before the first annual audit cycle is complete. We maintain independence from the external auditors through audit committee oversight, a robust regulatory framework in Canada, including the requirement to rotate the lead audit partner at least every five years, and Ernst & Young’s own internal independence procedures. The audit committee also conducts a formal review of the external auditors every year and a more comprehensive review every five years. The next comprehensive review is scheduled for 2024. The table below lists the services Ernst & Young provided to Manulife and its subsidiaries in the last two fiscal years and the fees they charged each year: (in millions) 2022 2021 Audit fees Includes the audit of our financial statements as well as the financial statements of our $44.5 $31.7 subsidiaries, segregated funds, audits of statutory filings, prospectus services, report on internal controls, reviews of quarterly reports and regulatory filings Audit-related fees Includes consultation concerning financial accounting and reporting standards not classified $3.6 $3.1 as audit, due diligence in connection with proposed or consummated transactions and assurance services to report on internal controls for third parties Tax fees $0.1 $0.6 Includes tax compliance, tax planning and tax advice services All other fees $0.2 $0.2 Includes other advisory services Total $48.4 $35.6 Note: Total fees above exclude fees of $10.5 million in 2022 and $9.7 million in 2021 for professional services provided by Ernst & Young LLP to certain investment funds managed by subsidiaries of Manulife. For certain funds, these fees are paid directly by the funds. For other funds, in addition to other administrative costs, the subsidiaries are responsible for the auditor’s fees for professional services, in return for a fixed administration fee. Audit fees for 2022 above also include one-time fees for special projects related to the implementation of IFRS 17 and IFRS 9 Financial Instruments of $10.9M. 12 Manulife Financial Corporation

About the Meeting Our auditor independence policy requires the Audit committee review audit committee to pre-approve all audit and The audit committee conducts a formal review permitted non-audit services (including the fees of the external auditors every year, and a more and conditions) the external auditor provides. comprehensive review every five years. These If a new service is proposed during the year that is reviews are based on recommendations by the outside the pre-approved categories or budget, it Chartered Professional Accountants of Canada must be pre-approved by the audit committee, or (CPA Canada) and the Canadian Public by a member that the committee has appointed to Accountability Board to assist the audit act on its behalf. committee in their oversight duties. A comprehensive review was conducted in The board recommends that you vote FOR the 2019, covering the five-year period ended appointment of Ernst & Young as auditors. December 31, 2018. The 2022 review included an evaluation of the engagement 4. Having a say on executive pay partner and team, their independence, (see page 39) objectivity and the quality of communication The board believes that executive compensation and audit work performed. In 2022, the lead programs must be sound, fair and competitive partner completed his term and a new lead with the market and support our strategy and partner was appointed. progress. We plan to initiate a tendering process for the The board recognizes the increased scrutiny of audit engagement in 2024 once the adoption executive compensation generally and believes of IFRS 17 and first annual audit cycle is that shareholders should have the opportunity to complete. fully understand our compensation objectives, philosophy and principles, and have a say on our approach to executive compensation. As a result, we’re asking you to vote on the following resolution: Resolved, on an advisory basis and not to diminish the role and responsibilities of the board of directors, that the shareholders accept the approach to executive compensation disclosed in the management information circular delivered in advance of the 2023 annual meeting of common shareholders of Manulife Financial Corporation. This is an advisory vote, so the results are not binding. The board will, however, take the results into account, together with feedback received from other shareholder engagement activities, when making decisions about compensation policies, procedures and executive pay in the future. We discuss our executive compensation program and the impact our performance had on executive compensation for 2022 in detail starting on page 40. This disclosure has been approved by the board on the recommendation of the management resources and compensation committee. The board recommends that you vote FOR our approach to executive compensation. 2023 Management information circular 13

Last year shareholders voted 91.71% in favour of our approach to executive compensation. If a significant number of shareholders oppose the resolution, the board will engage with shareholders (especially those who are known to have voted against it) to understand their concerns and will continue to review our approach to executive compensation in the context of those concerns. We encourage any shareholders who are thinking of voting against the resolution to contact the board to discuss their specific issues or concerns (see page 116 for details about how to contact the board and page 125 for details about our shareholder engagement activities). About shareholder proposals and proxy access Shareholder proposals We must receive shareholder proposals or nominations under our proxy access policy for our 2024 annual meeting by 5 p.m. (Eastern time) on December 15, 2023 to consider including them in next year’s management information circular. Shareholder proposal submissions must be in writing and meet the requirements of the Insurance Companies Act (Canada), which you can find online at https://laws-lois.justice.gc.ca/eng/acts/I-11.8/index.html. See page 126 for more information on our proxy access policy. Send your proposal or nomination notice to: Corporate Secretary Manulife Financial Corporation 200 Bloor Street East Toronto, Ontario M4W 1E5 Canada email: corporate_governance@manulife.com 14 Manulife Financial Corporation

About the directors Read about the nominated directors before you vote your shares. This year, 12 directors have been nominated for election to the board for a one-year term. They were all elected at our 2022 meeting. John Cassaday retired from the board on February 15, 2023 as he neared the end of his 5-year term as Chair of the Board. Joseph Caron is also reaching the end of his 12-year director term and will not stand for re-election. This group of directors has the mix of skills, experience and qualifications necessary for proper oversight and effective decision-making in the context of a complex, publicly-traded organization. Appropriate size Independent 12 All directors is within an appropriate range for directors are independent, except the CEO, and healthy debate end effective decision-making all board committee members are independent Qualified and financially literate Age All 63 directors bring a mix of the competencies and is the average age of the nominated directors experience necessary for effective oversight, and all are financially literate Diverse 7 3 of the nominated independent directors (64%) are of the nominated independent directors (27%) women have self-identified as members of a visible minority as defined in the Employment Equity Act (Canada). Balanced tenure 6 6.4 4 0 1 years is the average tenure of the nominated independent directors < 5 years 5-9 years 10-12 years > 12 years The board has a 12-year term limit. The Chair of the Board can serve a term of five years, regardless of the number of years served as a director. Where to find it Key things about the board 16 2022 board committee reports 30 Director profiles 18 How we pay our directors 35 2023 Management information circular 15

Key things about the board Diversity 2008 Gail Cook-Bennett is Our board recognizes the importance of diversity 2012 the first woman to and is committed to fostering diversity at all levels of Diversity policy serve as Chair of the the organization. The board has a long history of adopted, establishing Manulife Board promoting diversity and believes that having highly characteristics 2013 qualified directors from diverse backgrounds brings considered in different perspectives and experiences to the identifying board Women represent boardroom, generating healthy discussion and candidates more than 30% of debate and more effective decision-making. See independent directors page 129 for more about diversity. 2022 for the first time Gender parity achieved 7 of the nominated independent Increased commitment directors (64%) are women that women will 2023 3 of the nominated independent represent no less than Diversity policy enhanced: directors (27%) have self-identified as 40% of the independent • to maintain an members of a visible minority as defined directors (subject to appropriate gender fluctuations during balance, no more than in the Employment Equity Act (Canada). periods of transition) 60% of the independent Oversight directors will be from any one gender (subject Our board continued to provide effective oversight to fluctuations during and guidance to management throughout the periods of transition) past year and maintained a clear line of sight into • to reinforce the board’s commitment to significant areas of focus through regular diversity beyond gender, interactions, including the following: search firms • board and committee meetings, meetings with required to present management, written updates and informal diverse and balanced communications, and update calls in months slates of director that did not have a regularly scheduled meeting candidates, including those from • expanded the use of board focus groups as a underrepresented groups means of taking deep dives on key topics 27% of the independent • leveraged technology to continue to interact directors have self-identified with each other and management during board as members of a visible sessions, and gather ongoing feedback to minority1 confirm that all directors’ voices were heard • continued focus on board succession with a comprehensive succession process for the Chair of the Board to achieve an orderly transition, resulting in the appointment of Don Lindsay as Chair of the Board on February 15, 2023 • reviewed committee membership in light of the Chair of the Board succession process, implementing changes to reflect changing circumstances while maintaining effective oversight • implemented a hybrid meeting schedule with both in-person and virtual meetings to balance the importance of in-person interactions and the flexibility of virtual meetings given the global nature of the board to achieve optimal participation from all directors and to help attract talented directors from across the globe. 1 as defined in the Employment Equity Act (Canada). 16 Manulife Financial Corporation

About the Directors Majority voting Shareholders can vote for, or withhold their vote from, each director. Directors who receive more withhold than for votes must submit their resignation. The corporate governance and nominating committee will review the details surrounding the resignation and report to the board. The board will accept the resignation unless there are exceptional circumstances. The board will decide whether to accept the resignation within 90 days of the meeting and a news release will be issued disclosing the resignation or the reasons why the resignation was not accepted. The director will not participate in these deliberations. The resignation will be effective when it is accepted by the board. This policy applies only in uncontested elections, where the number of nominated directors is the same as the number of directors to be elected. 2022 attendance The table below shows the number of board and committee meetings held in 2022 and overall attendance. Quorum for board meetings is a majority of the directors and directors are expected to attend all meetings of the board and the committees they’re members of unless there are extenuating circumstances. Number of Overall meeting meetings attendance Board 8 100% Audit committee 5 100% Corporate governance and nominating committee 5 98% Management resources and compensation committee 5 100% Risk committee 5 100% Equity ownership The director profiles that follow include the value of In 2022, our independent directors were required each director’s equity ownership. We calculated the to receive at least 50% of the annual board value of equity ownership by multiplying the number retainer in equity. This increased to US$127,500 of their common shares and deferred share units (or approximately 55%) on January 1, 2023.The (DSUs) by $26.98, the closing price of our common director equity ownership requirement is six shares on the TSX on February 28, 2023. times the mandatory equity portion of the annual board retainer. We require all directors except Mr. Gori to own common shares, preferred shares and/or DSUs with a total market value of at least six times the mandatory equity portion of the annual board retainer. Mr. Gori has separate equity ownership requirements as President and CEO, which he meets (see page 107). In 2022, the mandatory equity portion of the annual board retainer was US$102,500. The corporate governance and nominating committee worked with an independent consultant to review director compensation again in 2022, and recommended that the board approve a 12% increase to director compensation to align with companies of similar complexity, received entirely in equity, and increasing the mandatory equity portion of the retainer to $127,500 (approximately 55% of the board retainer). This change went into effect January 1, 2023. Directors are expected to meet their equity ownership requirements within six years of joining the board. The minimum equity ownership requirement under the new model and as of February 28, 2023 was $1,041,089 (US$765,000, using an exchange rate of US$1.00 = $1.3609). Fluctuations in foreign exchange rates will cause variances in the minimum ownership requirements. 2023 Management information circular 17

Director profiles Donald R. Lindsay (Chair) Vancouver, BC, Canada/Age 64/Independent Key competencies and experience • Finance/Accounting • Technology/Operations • Risk management • Asia experience • Talent management/Executive compensation • Public company executive/Director Mr. Lindsay’s CEO and international business experience and nearly two decades of experience in senior executive roles in investment and corporate banking and global financial services qualify him to serve as the Chair of the Board and as chair of the corporate governance and nominating committee. Mr. Lindsay also has extensive ESG experience which will be valuable as Manulife seeks to implement its Impact Agenda and drive sustained social and environmental impact through our business and our interactions with customers, communities and the environments in which we operate. Don Lindsay was appointed as Chair of the Board on February 15, 2023. Director since Mr. Lindsay was previously President and CEO of Teck Resources Limited, August 2010 Canada’s largest diversified mining, mineral processing and metallurgical company, a position he held since 2005 where he led Teck to achieve top Term limit: rankings from ESG rating agencies such as S&P Global, MSCI and ISS ESG. His 2028 experience also includes almost two decades with CIBC World Markets Inc., where he ultimately served as President after periods as Head of Investment and 2022 votes for: 97.52% Corporate Banking and Head of the Asia Pacific Region. Mr. Lindsay currently serves on the Board of Directors for BC Children’s Hospital Foundation, Alpine Canada, York House School, and is an Honorary Governor of Public company boards the Royal Ontario Museum. He was Chair of the International Council on Mining (last five years) and Metals, Chair of the Board of Governors for Mining and Metals at the World Economic Forum, and recently completed his three-year term as Chair of the • Teck Resources Limited, Business Council of Canada. 2005-2022 Mr. Lindsay earned a Bachelor of Science in Mining Engineering from Queen’s University and holds an MBA from Harvard Business School, and has been the recipient of an Honorary Doctor of Laws from the University of Windsor and Honorary Doctorate of Technology from the British Columbia Institute of Technology. 2022 meeting attendance Board 8 of 8 100% Board committees • Management resources and compensation (chair) 5 of 5 100% • Risk 5 of 5 100% On February 15, 2023, Don Lindsay joined the corporate governance and nominating committee, also becoming committee chair, and resigned from the risk committee and management resources and compensation committee. Equity ownership (as at February 28, 20231 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 20,000 108,672 128,672 $3,471,571 3.3x 2022 20,000 96,046 116,046 $2,980,061 3.8x Change 0 12,626 12,626 1 As of March 15, 2023, Mr. Lindsay increased his personal MFC common share holdings to 120,000 shares, bringing his total equity holdings to 228, 672. The total value of his holdings, based on the closing price of our common shares on the TSX on February 28, 2023, was $6,169,570. With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 18 Manulife Financial Corporation

About the Directors Nicole S. Arnaboldi Greenwich, CT, U.S.A./Age 64/Independent Key competencies and experience • Finance/Accounting • Talent management/Executive compensation • Insurance/Reinsurance/Investment management • Asia experience • Risk management • Public company executive/Director Ms. Arnaboldi’s extensive experience at a major financial institution, specifically in the asset management field, qualifies her to serve on our board, as a member of the risk committee and as chair of the management resources and compensation committee. Nicole Arnaboldi is a partner at Oak Hill Capital Management, a private equity Director since firm. She is a former senior executive at Credit Suisse, a global financial services June 2020 company, and its predecessor Donaldson, Lufkin and Jenrette Securities Corporation, holding a number of senior roles in their wealth and asset Term limit: management businesses, including Senior Advisor, and prior to that, Vice 2033 Chairman, Credit Suisse Asset Management. Ms. Arnaboldi is a member of the boards of Commonfund and Merit Hill Capital 2022 votes for: 99.24% (non-public companies). She also serves on various Harvard University advisory boards, including for HarvardX and Harvard Law School. Public company boards Ms. Arnaboldi holds a Bachelor of Arts from Harvard College, and a JD and an (last five years) MBA from Harvard University. 2022 meeting attendance • NextEra Energy, Inc., 2022-present Board 8 of 8 100% Board committees • Audit 5 of 5 100% • Corporate governance and nominating 5 of 5 100% On February 15, 2023, Nicole Arnaboldi joined the management resources and compensation committee and became committee chair, joined the risk committee, and resigned from the corporate governance and nominating committee and audit committee. Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 6,500 31,157 37,657 $1,015,986 0.98x 2022 6,500 18,478 24,978 $641,435 0.8x Change 0 12,679 12,679 Ms. Arnaboldi joined the board on June 9, 2020. Under the director equity ownership requirements, she is expected to meet the equity ownership requirements within six years of joining the board. With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 2023 Management information circular 19

Guy L.T. Bainbridge Edinburgh, Midlothian, United Kingdom/Age 62/Independent Key competencies and experience • Finance/Accounting • Asia experience • Insurance/Reinsurance/Investment management • Public company executive/Director • Risk management Mr. Bainbridge’s extensive financial and audit experience qualifies him to serve on our board, as a member of the corporate governance and nominating committee and as chair of the audit committee. Guy Bainbridge is a former partner with KPMG LLP. He has acted as the key Director since audit leader of several of the UK and world’s largest financial institutions and August 2019 served on KPMG’s UK and Europe boards. Mr. Bainbridge also serves as the audit committee chair of each of Yorkshire Term limit: Building Society and ICE Clear Europe Limited (non-public companies). 2032 Mr. Bainbridge is a member of the Institute of Chartered Accountants in England 2022 votes for: 98.33% and Wales and holds a Master of Arts from the University of Cambridge. 2022 meeting attendance Public company boards Board 8 of 8 100% (last five years) Board committees • None • Audit (chair) 5 of 5 100% • Corporate governance and nominating 4 of 5 80% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 0 23,970 23,970 $646,711 0.6x 2022 0 16,105 16,105 $413,576 0.5x Change 0 7,865 7,865 Mr. Bainbridge joined the board on August 7, 2019. Under the director equity ownership requirements, he is expected to meet the equity ownership requirements within six years of joining the board. With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 20 Manulife Financial Corporation

About the Directors Susan F. Dabarno Bracebridge, ON, Canada/Age 70/Independent Key competencies and experience • Finance/Accounting • Asia experience • Insurance/Reinsurance/Investment management • Public company executive/Director • Talent management/Executive compensation • Digital transformation/Sales/Marketing • Technology/Operations Ms. Dabarno brings extensive global wealth management and financial services experience to the board, and her roles in various executive capacities and accounting background qualify her to serve on our board and as a member of the risk committee and the management resources and compensation committee. Susan Dabarno has been a corporate director since 2011. She has extensive Director since wealth management and distribution expertise and served from 2009 to 2010 as March 2013 Executive Chair, and from 2003 to 2009 as President and Chief Executive Officer, of Richardson Partners Financial Limited, an independent wealth management Term limit: services firm. Before joining Richardson Partners Financial Limited, Ms. Dabarno 2025 was President and Chief Operating Officer at Merrill Lynch Canada Inc. She is a former director of the Toronto Waterfront Revitalization Corporation 2022 votes for: 99.62% (government funded organization) and Bridgepoint Health Foundation (not-for-profit). Public company boards Ms. Dabarno is a Fellow of Chartered Professional Accountants (FCPA) and holds (last five years) a Class II Diploma from McGill University. • Cenovus Energy Inc., 2022 meeting attendance 2017-2021 Board 8 of 8 100% Board committees • Management resources and compensation 5 of 5 100% • Risk 5 of 5 100% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 45,250 33,952 79,202 $2,136,870 2.1x 2022 45,250 26,621 71,871 $1,845,647 2.4x Change 0 7,331 7,331 With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 2023 Management information circular 21

Julie E. Dickson Ottawa, ON, Canada/Age 65/Independent Key competencies and experience • Finance/Accounting • Government relations/Public policy/Regulatory • Insurance/Reinsurance/Investment management • Public company executive/Director • Risk management Ms. Dickson’s extensive financial, risk and regulatory experience qualifies her to serve on our board and as a member of the risk committee and the management resources and compensation committee. Julie Dickson is a former Superintendent of Financial Institutions, Canada, Director since Canada’s main financial services regulator. She currently serves on the August 2019 Canadian Public Accountability Board, and the boards of the Dubai Financial Services Authority and the Global Risk Institute. Term limit: Ms. Dickson is an Officer of the Order of Canada and holds a Bachelor of Arts 2032 from the University of New Brunswick and a Masters of Economics from Queen’s 2022 votes for: 99.58% University. 2022 meeting attendance Public company boards Board 8 of 8 100% (last five years) Board committees • None • Management resources and compensation 5 of 5 100% • Risk 5 of 5 100% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 0 44,420 44,420 $1,198,452 1.2x 2022 0 31,025 31,025 $796,722 1.0x Change 0 13,395 13,395 With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 22 Manulife Financial Corporation

About the Directors Roy Gori (President and Chief Executive Officer) Toronto, ON, Canada/Age 53/Not independent (management) Key competencies and experience • Finance/Accounting • Technology/Operations • Insurance/Reinsurance/Investment management • Asia experience • Risk management • Public company executive/Director • Talent management/Executive compensation • Digital transformation/Sales/Marketing Roy Gori is the President and Chief Executive Officer of Manulife, Canada’s largest insurance company, and one of the largest insurance and asset management companies in the world. Appointed in 2017, Mr. Gori’s tenure as CEO has been marked by the introduction of a clear strategy and values that build on Manulife’s strong foundations to include sharper focus on the customer and a shift to digital innovation, in line with the company’s mission to make customers’ decisions easier, and lives better. As a champion of diversity, equity and inclusion, Mr. Gori is the Chair of Director since Manulife’s DEI Council. He is also a passionate advocate for health and wellness, October 2017 promoting the benefits of behavioural insurance through award-winning products like Manulife Vitality and Manulife MOVE. Term limit: Mr. Gori joined Manulife as President and Chief Executive Officer for Asia in applies to independent that role, he was responsible for operations in 12 markets across Asia, directors only 2015. In driving Manulife’s rapidly growing business in the region. Mr. Gori started his 2022 votes for: 99.39% career at Citibank in 1989, where he held progressively senior roles and was finally responsible for the company’s Asia Pacific retail business, which included its insurance and wealth management business. Public company boards Mr. Gori holds a Bachelor of Economics and Finance from The University of New (last five years) South Wales, and an MBA from the University of Technology, Sydney. He is a • None member and on the Board of Directors of the Business Council of Canada, and is a member of the U.S. Business Council, the Geneva Association, and the Mayor of Shanghai’s International Business Leaders’ Advisory Council. A native Australian, Mr. Gori has worked and lived in Sydney, Singapore, Thailand, and Hong Kong, and is now based in Toronto. 2022 meeting attendance Board 8 of 8 100% Board committees Mr. Gori is not a member of any of the board committees but attends at the invitation of the Chair of the Board and/or committee chair Equity ownership As CEO, Mr. Gori has separate equity ownership requirements, which he meets. You can read more about this on page 107. 2023 Management information circular 23

Tsun-yan Hsieh Singapore, Singapore/Age 70/Independent Key competencies and experience • Finance/Accounting • Government relations/Public policy/Regulatory • Talent management/Executive compensation • Public company executive/Director • Technology/Operations • Digital transformation/Sales/Marketing • Asia experience Mr. Hsieh’s extensive management leadership, management consulting and academic experience, combined with his Asia perspective, qualifies him to serve on our board, and as a member of the audit committee and the corporate governance and nominating committee. Tsun-yan Hsieh is Chairman of LinHart Group PTE Ltd., a firm he founded in Director since 2010 to provide leadership services internationally. October 2011 Mr. Hsieh, a resident of Singapore, has extensive consulting experience in Term limit: business strategy, leadership development and corporate transformation. 2024 Mr. Hsieh joined McKinsey & Company in 1980 and was elected a director from 1990 to 2008, when he retired. During his tenure, he served as Managing 2022 votes for: 98.83% Director of Canada and ASEAN practices and led McKinsey’s Organization and Leadership Practice globally. Mr. Hsieh is a director on the following non-public boards: LinHart Group PTE Public company boards Ltd. and Singapore Health Services Pte. Ltd. He also serves as Provost Chair (last five years) Professor at the NUS Business School and the Lee Kuan Yew School of Public • Singapore Airlines, Policy. 2012-present Mr. Hsieh has a Bachelor of Science in Mechanical Engineering from the University of Alberta and an MBA from Harvard Business School. 2022 meeting attendance Board 8 of 8 100% Board committees • Audit 5 of 5 100% • Corporate governance and nominating 5 of 5 100% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 0 164,168 164,168 $4,429,253 4.3x 2022 0 144,311 144,311 $3,705,906 4.7x Change 0 19,856 19,856 With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 24 Manulife Financial Corporation

About the Directors Vanessa Kanu Ottawa, ON/Age 45/Independent Key competencies and experience • Finance/Accounting • Technology/Operations • Risk management • Asia experience • Talent management/Executive compensation • Public company executive/Director Ms. Kanu’s expertise in public company finance and her extensive leadership experience qualify her to serve on our board and as a member of the audit committee and corporate governance and nominating committee. Vanessa Kanu is a seasoned finance professional with over 20 years of business Director since experience. Ms. Kanu currently serves as global CFO at TELUS International, February 2022 responsible for finance operations, including accounting, treasury, taxation, planning and analysis and reporting. Term limit: Ms. Kanu currently sits on the board of the Ottawa Hospital Foundation. 2034 Ms. Kanu is a Chartered Accountant in Canada, a Certified Public Accountant in 2022 votes for: 98.85% the United States (Illinois), and a member of the Institute of Chartered Accountants of England and Wales. She holds a Bachelor of Science degree in Public company boards International and Financial Economics from the University of Hull, UK. (last five years) 2022 meeting attendance • None Board 6 of 6 100% Board committees • Audit 4 of 4 100% • Corporate governance and nominating 4 of 4 100% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common Total multiple of equity Year shares DSUs shares and DSUs value ownership guideline 2023 0 4,988 4,988 $134,576 0.1x 2022 0 0 0 $ 0 N/A Change 0 4,988 4,988 Ms. Kanu joined the board on February 28, 2022. Under the director equity ownership requirements, she is expected to meet the equity ownership requirements within six years of joining the board. With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 2023 Management information circular 25

C. James Prieur Chicago, IL, U.S.A./Age 71/Independent Key competencies and experience • Finance/Accounting • Technology/Operations • Insurance/Reinsurance/Investment management • Asia experience • Risk management • Public company executive/Director • Talent management/Executive compensation Mr. Prieur’s strong financial background and his wealth of senior executive experience in the insurance business in Canada, the U.S. and globally qualify him to serve on our board, as a member of the management resources and compensation committee and as chair of the risk committee. James Prieur has been a corporate director since 2011 and, prior to that time, Director since Mr. Prieur served as Chief Executive Officer and director of CNO Financial January 2013 Group, Inc. from 2006 until his retirement in 2011. CNO Financial Group is a life insurance holding company focused on the senior middle income market in the Term limit: U.S. Prior to joining CNO Financial Group, Mr. Prieur was President and Chief 2025 Operating Officer of Sun Life Financial, Inc. from 1999 to 2006 where he had previously led operations in Asia, Canada, U.S., and the UK. 2022 votes for: 99.60% He is a member of the President’s Circle of the Chicago Council on Global Affairs, a not-for-profit organization. Public company boards Mr. Prieur is a Chartered Financial Analyst and holds an MBA from the Richard (last five years) Ivey School at Western University and a Bachelor of Arts from the Royal Military • Ambac Financial Group, College of Canada. Inc., 2016-2023 2022 meeting attendance Board 8 of 8 100% Board committees • Management resources and compensation 5 of 5 100% • Risk (chair) 5 of 5 100% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 200,000 149,604 349,604 $9,432,316 9.1x 2022 145,000 128,387 273,387 $7,020,578 9.0x Change 55,000 21,217 76,217 With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 26 Manulife Financial Corporation

About the Directors Andrea S. Rosen Toronto, ON, Canada/Age 68/Independent Key competencies and experience • Finance/Accounting • Talent management/Executive compensation • Risk management • Public company executive/Director • Insurance/Reinsurance/Investment management Ms. Rosen’s experience as a global financial services executive with particular experience in investment banking, wholesale and retail banking, risk management, human resources management and executive compensation qualifies her to serve on our board and as a member of the audit committee and corporate governance and nominating committee. Andrea Rosen has been a corporate director since 2006. Prior to January 2005, Director since her experience includes more than a decade with TD Bank Financial Group, August 2011 where she ultimately served as Vice Chair, TD Bank Financial Group and President of TD Canada Trust. Earlier in her career, she held progressively senior Term limit: positions at Wood Gundy Inc. and was Vice President at Varity Corporation. 2024 She serves on the board of the Institute of Corporate Directors (not-for-profit). 2022 votes for: 98.49% Ms. Rosen has an LLB from Osgoode Hall Law School, an MBA from the Schulich School of Business at York University and a Bachelor of Arts from Yale Public company boards University. (last five years) 2022 meeting attendance • Ceridian HCM Holding Board 8 of 8 100% Inc., 2018-present Board committees • Element Fleet • Audit 5 of 5 100% Management Corp., • Corporate governance and nominating (chair) 5 of 5 100% 2019-present • Emera Inc., On February 15, 2023, Andrea Rosen resigned as chair of the corporate governance and 2007-present nominating committee. Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 11,500 169,932 181,432 $4,895,035 4.7x 2022 11,500 147,618 159,118 $4,086,150 5.2x Change 0 22,313 22,313 With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 2023 Management information circular 27

May Tan Hong Kong/Age 67/Independent Key competencies and experience • Finance/Accounting • Talent management/Executive compensation • Insurance/Reinsurance/Investment management • Asia experience • Risk management • Public company executive/Director Ms. Tan’s extensive leadership experience in financial services and her deep knowledge of the industry in Asia qualify her to serve on our board and as a member of the corporate governance and nominating committee and audit committee. May Tan is a senior financial services executive who has held a number of senior Director since roles at Standard Chartered Bank, including the position of Chief Executive December 2021 Officer, Standard Chartered Bank (Hong Kong). She has over 30 years of experience in corporate finance, banking, and capital markets in Asia. She holds Term limit: the Fellow Chartered Accountant designation from the Institute of Chartered 2034 Accountants in England and Wales and the Certified Public Accountant (Fellow) designation from the Hong Kong Institute of Certified Public Accountants. 2022 votes for: 99.74% Ms. Tan is a director on the following non-public boards: Anticimex New TopHolding AB, MSIG Insurance (Hong Kong) Limited, Shanghai Guardian Limited and 701 Limited. Ms. Tan is also a council member of the Asian Corporate Public company boards Governance Association. (last five years) Ms. Tan received a B.A. in Economics and Accounting from the University of • CLP Holdings Limited Sheffield. 2018-present 2022 meeting attendance • JP Morgan China Board 8 of 8 100% Growth & Income PLC 2021-present Board committees • Link Management • Management resources and compensation 5 of 5 100% Limited/Link REIT • Risk 5 of 5 100% 2013-2022 On February 15, 2023, May Tan joined the corporate governance and nominating committee and audit committee, and resigned from the management resources and compensation committee and risk committee. Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common multiple of equity Year shares DSUs shares and DSUs Total value ownership guideline 2023 0 6,287 6,287 $169,623 0.2x 2022 0 449 449 $11,530 0.0x Change 0 5,838 5,838 Ms. Tan joined the board on December 1, 2021. Under the director equity ownership requirements, she is expected to meet the equity ownership requirements within six years of joining the board. With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 28 Manulife Financial Corporation

About the Directors Leagh E. Turner Toronto, ON, Canada/Age 51/Independent Key competencies and experience • Risk management • Asia experience • Talent management/Executive compensation • Public company executive/Director • Technology/Operations • Digital transformation/Sales/Marketing Ms. Turner’s extensive executive experience in the technology sector and leadership expertise leveraging people, process and technology to drive organizational transformation qualify her to serve on our board and as a member of the risk committee and the management resources and compensation committee. Leagh Turner is a seasoned global executive in the technology sector currently Director since holding the position of Co-CEO for Ceridian HCM Holding Inc., a global human November 2020 capital management software company. She also serves as a director of Plan International Canada. Ms. Turner is a strong advocate for the advancement of Term limit: women in leadership and has been recognized twice on the WXN (Women’s 2033 Executive Network) Canada’s Top 100 Most Powerful Women list. Ms. Turner holds a Bachelor of Arts from the University of Western Ontario. 2022 votes for: 99.32% 2022 meeting attendance Public company boards Board 8 of 8 100% (last five years) Board committees • Ceridian HCM Holding • Management resources and compensation 5 of 5 100% Inc., 2022-present • Risk committee 5 of 5 100% Equity ownership (as at February 28, 2023 and February 28, 2022) Total value as a Common Total common Total multiple of equity Year shares DSUs shares and DSUs value ownership guideline 2023 0 12,279 12,279 $331,287 0.3x 2022 0 6,117 6,117 $157,085 0.2x Change 0 6,161 6,161 Ms. Turner joined the board on November 10, 2020. Under the director equity ownership requirements, she is expected to meet the equity ownership requirements within six years of joining the board. With the changes to director compensation that went into effect January 1, 2023, the equity ownership requirement increased to $1,041,089 (US$765,000). The total value as a multiple of equity ownership guideline shown above relates to the guideline in effect for each respective year. See page 5 for information about equity ownership 2023 Management information circular 29

2022 board committee reports Corporate governance and nominating committee Membership as of All members of the corporate governance and nominating committee are December 31, 2022:* independent. The Chair of the Board is also a member. There is cross- Andrea S. Rosen – Chair membership between the corporate governance and nominating committee and Nicole S. Arnaboldi the audit committee. Guy L.T. Bainbridge The committee met five times in 2022. It has approved this report and is Joseph P. Caron satisfied that it has carried out all of the responsibilities required by the John M. Cassaday committee charter. Tsun-yan Hsieh Vanessa Kanu * On February 15, 2023, Don Lindsay joined the committee and became committee chair, May Tan joined the committee, and Nicole Arnaboldi and John Cassaday resigned from the committee. Key responsibilities Key activities Managing board renewal and • Continued oversight and focus on board succession and diversity strategy. succession, including • Worked with independent recruitment firm to assist in identifying and recruiting identifying the necessary potential candidates based on criteria established by the committee, including competencies, expertise, a diverse slate of candidates as mandated by the board diversity policy. skills, background and • Maintained and regularly refined the evergreen list of potential director personal qualities for candidates. potential candidates, • Led searches to identify new director candidates in line with the board’s overall identifying qualified needs and diversity policy, and led the vetting process. candidates, maintaining an • Reviewed the characteristics, experience and expertise necessary for evergreen list of qualified prospective directors to align with Manulife’s ambitions for the future. candidates and reviewing • Considered board diversity in the context of director succession planning and committee membership reviewed the board’s diversity policy. Enhanced board diversity policy to provide for gender balance and to reinforce the board’s commitment to diversity beyond gender. • Reviewed committee membership and recommended committee appointments for new director. Developing effective • Oversaw the company’s ESG framework, including matters related to climate corporate governance policies change. On a regular basis, the committee is updated on relevant climate and procedures, including topics, including our progress against the commitments set out in Manulife’s subsidiary governance and Climate Action Plan. environmental, social and • Reviewed reports on ESG strategy, trends, risks and opportunities. governance (ESG) issues • Reviewed ESG reporting, including the company’s 2021 Sustainability Report and key performance indicators, and reviewed stakeholder feedback on the report. • Reviewed updates on the company’s sustainability strategy, including the company’s Impact Agenda and direction and areas of focus for the company in this area. • Reviewed the details of, and compliance with, board and committee charters and mandates of board and committee chairs, directors and the CEO. • Considered all significant changes in director status and confirmed no adverse impact. • Monitored and received reports on corporate governance developments, assessing current practices against emerging best practices and other requirements, and enhancing practices where relevant. • Reviewed reports on the company’s virtual annual meeting of shareholders, designed to allow shareholder participation in the pandemic environment. • Reviewed reports on subsidiary governance and the company’s subsidiary governance framework. • Reviewed reports on shareholder feedback. 30 Manulife Financial Corporation