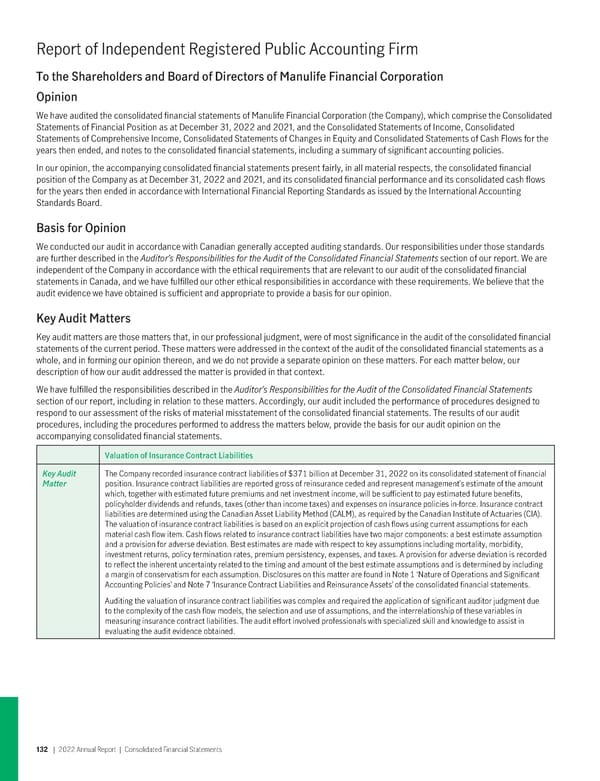

Report of Independent Registered Public Accounting Firm To the Shareholders and Board of Directors of Manulife Financial Corporation Opinion We have audited the consolidated financial statements of Manulife Financial Corporation (the Company), which comprise the Consolidated Statements of Financial Position as at December 31, 2022 and 2021, and the Consolidated Statements of Income, Consolidated Statements of Comprehensive Income, Consolidated Statements of Changes in Equity and Consolidated Statements of Cash Flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2022 and 2021, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Key Audit Matters Key audit matters are those matters that, in our professional judgment, were of most significance in the audit of the consolidated financial statements of the current period. These matters were addressed in the context of the audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. For each matter below, our description of how our audit addressed the matter is provided in that context. We have fulfilled the responsibilities described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report, including in relation to these matters. Accordingly, our audit included the performance of procedures designed to respond to our assessment of the risks of material misstatement of the consolidated financial statements. The results of our audit procedures, including the procedures performed to address the matters below, provide the basis for our audit opinion on the accompanying consolidated financial statements. Valuation of Insurance Contract Liabilities KeyAudit The Company recorded insurance contract liabilities of $371 billion at December 31, 2022 on its consolidated statement of financial Matter position. Insurance contract liabilities are reported gross of reinsurance ceded and represent management’s estimate of the amount which, together with estimated future premiums and net investment income, will be sufficient to pay estimated future benefits, policyholder dividends and refunds, taxes (other than income taxes) and expenses on insurance policies in-force. Insurance contract liabilities are determined using the Canadian Asset Liability Method (CALM), as required by the Canadian Institute of Actuaries (CIA). The valuation of insurance contract liabilities is based on an explicit projection of cash flows using current assumptions for each material cash flow item. Cash flows related to insurance contract liabilities have two major components: a best estimate assumption and a provision for adverse deviation. Best estimates are made with respect to key assumptions including mortality, morbidity, investment returns, policy termination rates, premium persistency, expenses, and taxes. A provision for adverse deviation is recorded to reflect the inherent uncertainty related to the timing and amount of the best estimate assumptions and is determined by including a margin of conservatism for each assumption. Disclosures on this matter are found in Note 1 ‘Nature of Operations and Significant Accounting Policies’ and Note 7 ‘Insurance Contract Liabilities and Reinsurance Assets’ of the consolidated financial statements. Auditing the valuation of insurance contract liabilities was complex and required the application of significant auditor judgment due to the complexity of the cash flow models, the selection and use of assumptions, and the interrelationship of these variables in measuring insurance contract liabilities. The audit effort involved professionals with specialized skill and knowledge to assist in evaluating the audit evidence obtained. 132 | 2022AnnualReport | ConsolidatedFinancialStatements

2022 Annual Report Page 133 Page 135

2022 Annual Report Page 133 Page 135